Astellas Pharma acquires Iveric Bio for a reported $5.9 billion

Astellas Pharma has agreed to acquire Iveric Bio for a reported $5.9 billion (USD) with the goal of continuing progress in the innovation of ophthalmic therapeutics.

Astellas Pharma Inc. and Iveric Bio announced the companies have entered into a definitive agreement under which Astellas through Berry Merger Sub Inc., a wholly-owned subsidiary of Astellas US Holding, Inc., has agreed to acquire 100% of the outstanding shares of Iveric Bio.

Japan-based Astellas is buying Iveric Bio Inc for about $5.9 billion in its biggest acquisition, giving it access to a range of ophthalmology treatments.

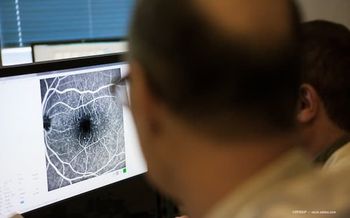

Based in New Jersey, Iveric focues on the development of treatment options retinal diseases, which is in line with Astellas' focus on blindness and regeneration therapies.

The companies noted in a news release that in the acquisition, Iveric Bio will become an indirectly wholly owned subsidiary of Astellas.

"We are pleased to reach an agreement with Iveric Bio, a company with exceptional expertise in the R&D of innovative therapeutics in the ophthalmology field." Naoki Okamura, president and CEO, Astellas, said in a news release. "Iveric Bio has promising programs including avacincaptad pegol (ACP), an important program for geographic atrophy secondary to Age-Related Macular Degeneration, and capabilities across the entire value chain in the ophthalmology field. We believe that this acquisition will enable us to deliver greater VALUE to patients with ocular diseases at high risk of blindness."

"This transaction with Astellas, a highly respected pharmaceutical company, demonstrates the significant value that we have built for our stockholders and recognizes the tremendous work by our dedicated team at Iveric Bio," said Glenn P. Sblendorio, CEO of Iveric Bio.

"The opportunity to create a world-class entity with the ophthalmology expertise and capabilities of Iveric Bio and the global reach and resources of Astellas is unique and has the potential to benefit patients worldwide suffering from blinding retinal diseases, including GA," said Pravin U. Dugel, MD, president of Iveric Bio.

Strategic objectives of the acquisition

According to the companies Astellas aims to become a cutting-edge, value-driven life science innovator to realize its to be "on the forefront of healthcare change to turn innovative science into value for patients.

Iveric Bio focuses on the discovery and development of novel treatments in the field of ophthalmology. The company announced in February that the FDA accepted for filing a New Drug Application (NDA) for ACP for the treatment of GA secondary to AMD. The NDA has been granted priority review with a Prescription Drug User Fee Act (PDUFA) goal date of August 19.

ACP, a complement C5 inhibitor, is an investigational drug for GA secondary to AMD and has significant potential to deliver value to a large and underserved patient base. ACP met its primary efficacy endpoint (reduction of the rate of GA progression) with statistical significance across two pivotal clinical trials, (GATHER Clinical Trials) and has received breakthrough therapy designation*1 from the FDA for this indication.

In addition, the acquisition of Iveric Bio will provide a foundation of ophthalmology focused capabilities, including a multi-faceted commercial team, expansive network of experts in the ophthalmology field, established relationships with medical institutions, and the infrastructure and experience to drive the company's combined ophthalmology business going forward.

Furthermore, through acquired capabilities, Astellas will accelerate pre-clinical and clinical development and commercialization activities to positively contribute to the goals of Primary Focus, "Blindness & Regeneration."

According to the news release, funds for the acquisition consist of newly procured funds from bank loans and issuing of commercial paper totaling approximately 800 billion yen and existing cash on hand. Astellas expects to repay this debt within the next five to seven years. The completion of the Acquisition is not subject to a financing condition. Astellas does not anticipate making any change in its dividend policy following the Acquisition.

The companies noted the closing of the proposed acquisition is subject to approval by Iveric Bio's stockholders and other customary closing conditions, including receipt of required regulatory approvals. The companies expect to complete the Acquisition in the second quarter of Astellas' fiscal year 2023 (third calendar quarter of 2023).

Newsletter

Keep your retina practice on the forefront—subscribe for expert analysis and emerging trends in retinal disease management.